Issuers Strengthen Debit Program Performance, Confront Challenges

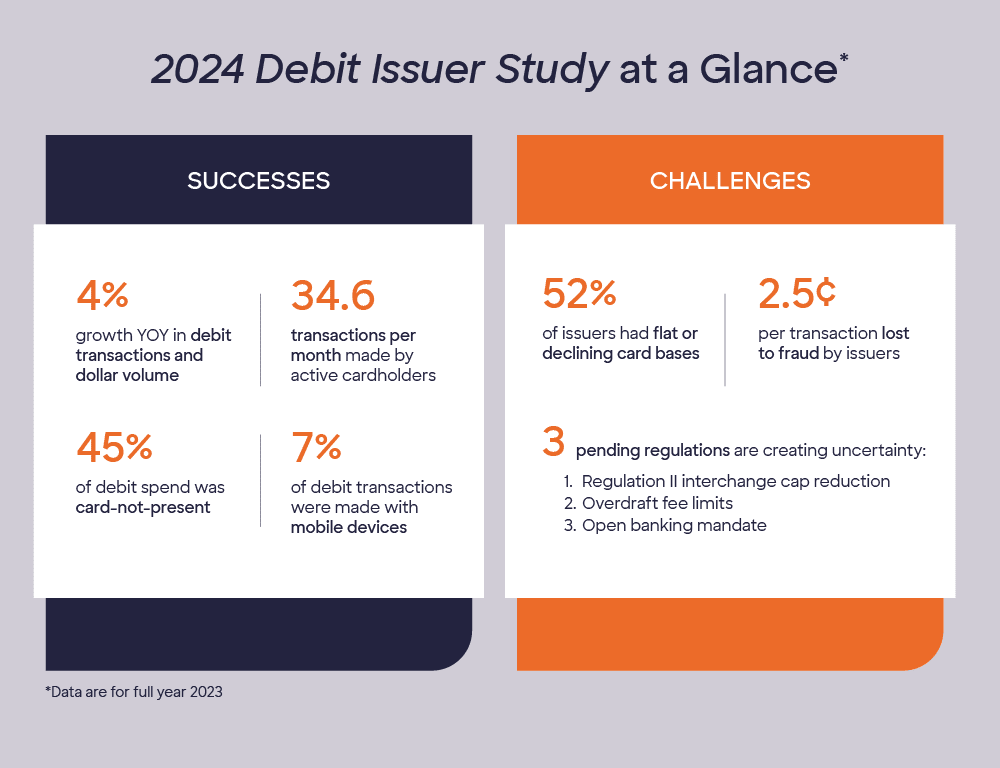

Debit payments continued to grow and evolve in 2023, with more card use shifting to card-not-present (CNP) and mobile transactions. This is a key finding from the 2024 Debit Issuer Study.

“By offering the convenience of digital payment options and focusing on fraud prevention, issuers are empowering their cardholders to use debit in more ways across a broader range of channels,” said Steve Sievert, PULSE Executive Vice President of Marketing and Brand Management.

At the same time, debit issuers face a number of challenges, ranging from customer retention to regulatory uncertainty. Despite these headwinds, financial institutions remain cautiously optimistic about the future of their debit portfolios.

Debit Use Continues to Evolve

Despite a year-over-year (YOY) increase of only 1% in the number of debit cards for the issuers surveyed, debit transactions and dollar volume each rose 4% YOY in 2023. Active cardholders completed 34.6 transactions per month in 2023, including 30.7 point-of-sale (POS) transactions, 2 account-to-account transfers, and 1.9 ATM transactions.

POS use per card grew at an average annual rate of 4.4% between 2018 and 2023. The average debit ticket size was $46.89 in 2023, an increase of 3.4% per year, on average, over the period. Annual spend per active card was $17,274, up an average 8.1% per year between 2018 and 2023.

Debit use has not just grown but shifted in the past decade. More than one-third (36%) of debit transactions and 45% of debit spend is now in the CNP channel. And mobile devices account for 7% of debit transactions. These two metrics were essentially zero a decade ago.

Issuer Performance Remains Strong

The key performance indicators issuers use to track their debit portfolios are penetration, active, and usage (PAU) rates. Issuers reported a debit penetration rate (percentage of accounts with an associated debit card) of 80.5%, improving by an average 0.6% per year between 2018 and 2023. Debit card active rates (the percentage of debit cards used regularly) declined slightly (-0.2% per year) over the period to 66.3% in 2023.

“I would caution that industry averages do not tell the full story, as there is considerable variation across issuers,” said Sievert. “Issuers in the top quartile of performance, which we call ‘best-in-class’, have PAU metrics that are significantly higher than their peers. These differences reflect strong debit management, as well as disparities in the profiles and operating models of the institutions.”

Shifting Dynamics Bring Challenges

In addition to benefiting from debit’s continued growth and evolution, issuers are confronting a number of challenges. Key among them are:

-

- Customer retention

More than half (52%) of traditional financial institutions have flat to declining account bases, meaning the number of accounts lost in 2023 equaled or exceeded the number of new accounts. The trend may reflect consumers’ migration toward digital challenger banks and away from traditional institutions. Regardless, issuers in this category find it difficult to achieve year-over-year debit growth targets.

-

- Fraud

As debit use shifts towards digital channels, fraud also changes. While third-party fraud remains a challenge, first-party fraud is becoming more common in the CNP channel. CNP transactions generate a higher number of disputes, placing an operational burden on issuers. Of every 10,000 transactions, eight are disputed, but only 2.6 ultimately generate a loss to the issuer. On average, issuers lose 2.5¢ per transaction to fraud, on a net basis. Issuers must continuously strive to stop as much fraud as possible while trying not to inconvenience account holders in the process.

-

- Regulation

Proposed regulations could materially impact the economics of demand deposit accounts. The Federal Reserve is expected to lower the interchange cap for covered issuers when its final Regulation II rule is released. In addition, Illinois plans to exempt sales tax and gratuities from interchange, and other state legislatures are proposing similar rules. And the Consumer Financial Protection Bureau is planning two new rules. The first would limit the fee institutions can charge for overdrafts, most of which are initiated by debit cards. The second, related to open banking, would require all institutions to make their customer data available to authorized third parties.

Each of these regulations was developed independently, but it is their cumulative impact that creates the greatest concern among financial institutions. One issuer subject to the Federal Reserve’s planned interchange cap reduction put it this way: “The projected loss of overdraft revenue is of the same magnitude as the proposed reduction in our debit interchange income. Taken together, this will be a very difficult adjustment for us.”

-

- Faster Payments

Issuers are divided on the potential impact of the Real-Time Payments (RTP) and FedNow services. There are three prevailing points of view:

-

-

- Faster payments have minimal overlap with debit, catering to different users and use cases.

- Because RTP and FedNow provide no interchange, any migration from debit will erode issuer income.

- Because the systems lack robust disputes and chargeback processes, they introduce risk.

-

Issuer Outlook

Financial institutions are cautiously optimistic about the outlook for their debit portfolios. Debit managers have three top priorities for the remainder of 2024 and 2025:

-

-

- Continue to optimize PAU

- Strengthen the fight against both first- and third-party fraud

- Invest in new digital capabilities

-

Concurrent with tackling these priorities, issuers also need to address – or be ready to address – three macro trends:

-

-

- The Federal Reserve’s likely reduction in the maximum interchange rate that covered issuers can receive

- Increased competition among both traditional financial institutions and digital challengers

- The growth of faster payment systems and their potential impact on an institution’s overall payment revenue and risk profile

-

For more information on the study findings, visit the 2024 Debit Issuer Study web page or download our white paper.